Much has been said about the value of working with an independent insurance broker for all your insurance needs. Unlike buying directly online from the insurance company or through an insurance agent, dealing with a broker means that you have access to more than one insurer.

If you buy direct, and the insurance company has lousy rates for a driver with your profile, or if they increase their rates over time, there’s not much you can do. It’s like going to a restaurant that only has one item on the menu, or golfing with one club in your bag. There are no options. The price is the price, as filed with a provincial regulatory body, no negotiation, no plan B.

If you don’t go through a broker and you have a dispute with your insurer, about premiums, about a claim or something else, you’re on your own. Nobody you talk to at the insurance company is going to tell you, hey, I think you can probably get a better rate, or better service, at ABC Insurance down the street.

If you’re shopping through a broker, on the other hand, good for you! Your menu is expanding. If you’re sick of the fish tacos, you can always go for the club sandwich instead. A licensed insurance broker will shop the market for you and offer you the best rate they can find for the coverage you need. Importantly, they can also advocate on your behalf in a dispute. They work for you, not the insurer.

Will any broker do?

Although the broker model is the best way to buy insurance, be careful when choosing your broker. Not all brokers represent all insurance companies. They have to negotiate contracts to sell for each insurance company, so some brokers only work with 3 or 4 companies, while others work with 40 or more. Think 40 menu items compared to 3. You can imagine that a broker with access to 40 insurance companies is much more likely to find you the best rate than the one with 3.

The other important detail is that not all insurers sell every kind of insurance. If your broker has access to 5 companies, but 2 of them only sell business insurance, then your car insurance options are severely limited. Always ask how many companies they work with, and try to choose a broker with at least 20 insurers.

There are also some brokers that are wholly or partially owned by an insurance company. They are subject to the same rules as other brokers and will provide competitive quotes for you. But it is something you might want to be aware of, as it could lead to an unintentional bias. The insurance industry is going through a lot of mergers and acquisitions, which often leads to less market choice for you as a consumer; you may want to consider the storyline of the broker you are dealing with, and what their future looks like.

Is your broker part of a larger team?

The other thing to consider is the brokerage’s organizational structure. Are they working as one team or as a bunch of individual representatives? Is the broker you’re talking to part of a bigger team you can lean on, or are they solely responsible for end-to-end service on all their clients?

There are two common models for insurance brokerages. The first is essentially a grouping of mostly independent brokers who share certain common costs like marketing and administration. In this model, each broker is on their own to service their clients. This can be nice, as you will always deal with the same person and get personalized service. But what happens when your broker is sick, on vacation, or busy with other clients? Sometimes these individual brokers grow their client base big enough to hire some help and start building a team, which can help.

The other common type of brokerage is a team model, like our insurance team, where the whole team works together for one vision. In this model, the roles are often specialized for sales, service, claims, marketing etc. If you’re dealing with a team brokerage, you’ll talk to a number of different people at the brokerage depending on the situation, but you’ll usually have longer service hours, and lots of backup if the person you’re looking for is unavailable.

Lastly, don’t discount the value of service. Does your broker have weekend hours? Do they have a claims line you can call? Do they staff a specialist for that line? The nice thing about this is that because the broker doesn’t represent the insurance company, you can call them for advice before you make a claim. They may even advise you not to make a claim if they know it will affect your future rates. If you call the insurance company with a potential claim, the second they answer the phone, whatever happened (fender bender etc.) is on the record, and even if you decide to pay for damage yourself, it could still affect your premiums.

What about online rate comparison tools?

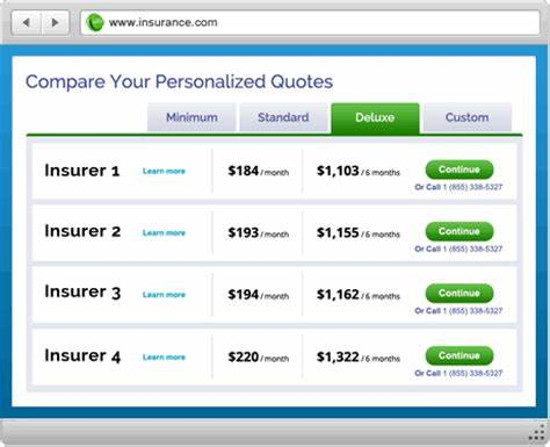

Besides a broker, you can also access a multitude of different rates using an online rate comparison tool. There are a number of these sites out there, but they all funnel up to two companies that own them and all of them use the same rate calculation. Although both companies also own insurance brokerages on the side, they make most of their revenue by selling the information you provide (called a ‘sales lead’) to other brokers and insurance companies, who then follow up and try to sell you a policy.

The problem with these online services selling your information to other providers is that they will naturally try to direct you to the companies that happen to be buying leads. Want a fun experiment? Get a quote from a comparison site at 8am, when every insurance company is buying leads, and then run the quote again on the same site at 9pm, when only a few companies are buying leads. If you enter all your info correctly, your premium with a given company shouldn’t change, but the fact is you may not see the same set of quotes at 9pm, so your best option from 8am may not be available. You can run the same experiment on Monday vs. Sunday. This is not necessarily to your benefit.

The other problem with online quotes is that the quoting software isn’t sophisticated enough to this point to provide a 100% accurate quote every time. Quotes don’t always reflect the final price of the policy. After you choose the quote you want and ask to finalize your insurance, you could end up paying significantly more than you were quoted for a variety of reasons. This can be frustrating, and given the limitations of the online quoting technology right now, it’s probably best to talk directly with a broker to get a quote you can count on. The convenience of an online quote might be attractive to you, but the process is not nearly as automated as you think.

What to ask your insurance representative

Before you decide on a broker or other insurance provider, ask them the following questions:

- How many insurance companies do you represent? How many of those offer the insurance product I’m looking for?

- Can I see a breakdown of those companies, comparing prices and coverage options?

- Are you growing? Are you actively trying to increase the number of choices I have?

- How do you compare to other brokerages? Have you won any awards?

- What do your customers think of you? Can I see reviews and testimonials?

- What are your hours? Can I reach you after 5 if I need to? Can I reach you on the weekend?

- Are you independent or fully or partially owned by an insurance company?

- Do you offer claims assistance? How?

- If you are not available, what does the backup team look like?

It’s time to ask some tough questions. The great brokers won’t mind you asking, the lesser brokers won’t have great answers, and the insurance companies that sell direct may try to avoid answering altogether.

Happy shopping!

We’ll shop the best insurance companies in Ontario for you.

Speak with a Mitch Insurance broker today to get a quote on insurance in Ontario. Learn more >

Call now

1(403)8000267